city of richmond property tax inquiry

Disabled Veterans or their surviving spouses who believe they may be eligible for the real estate tax. Team papergov 11 months ago.

Toronto Property Tax 2021 Calculator Rates Wowa Ca

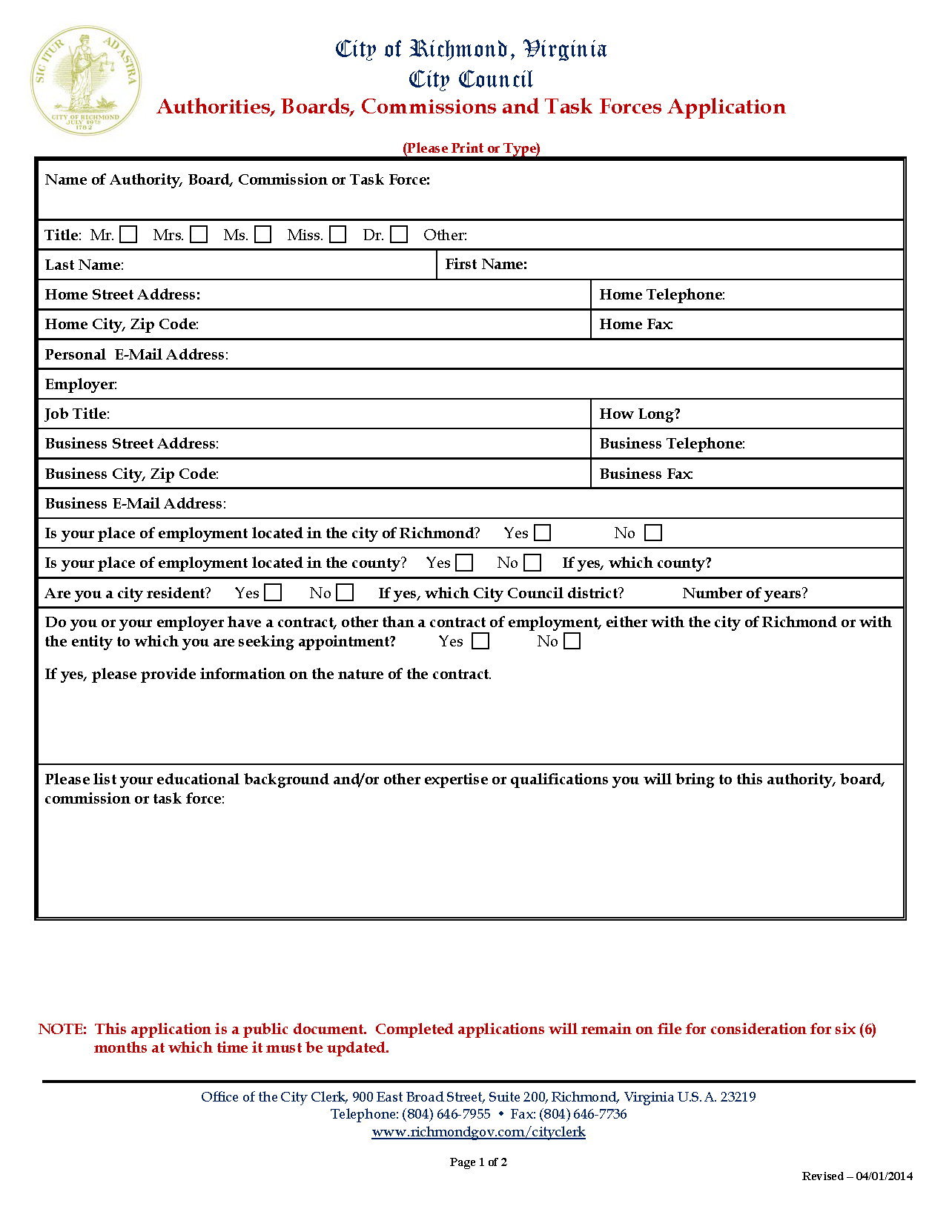

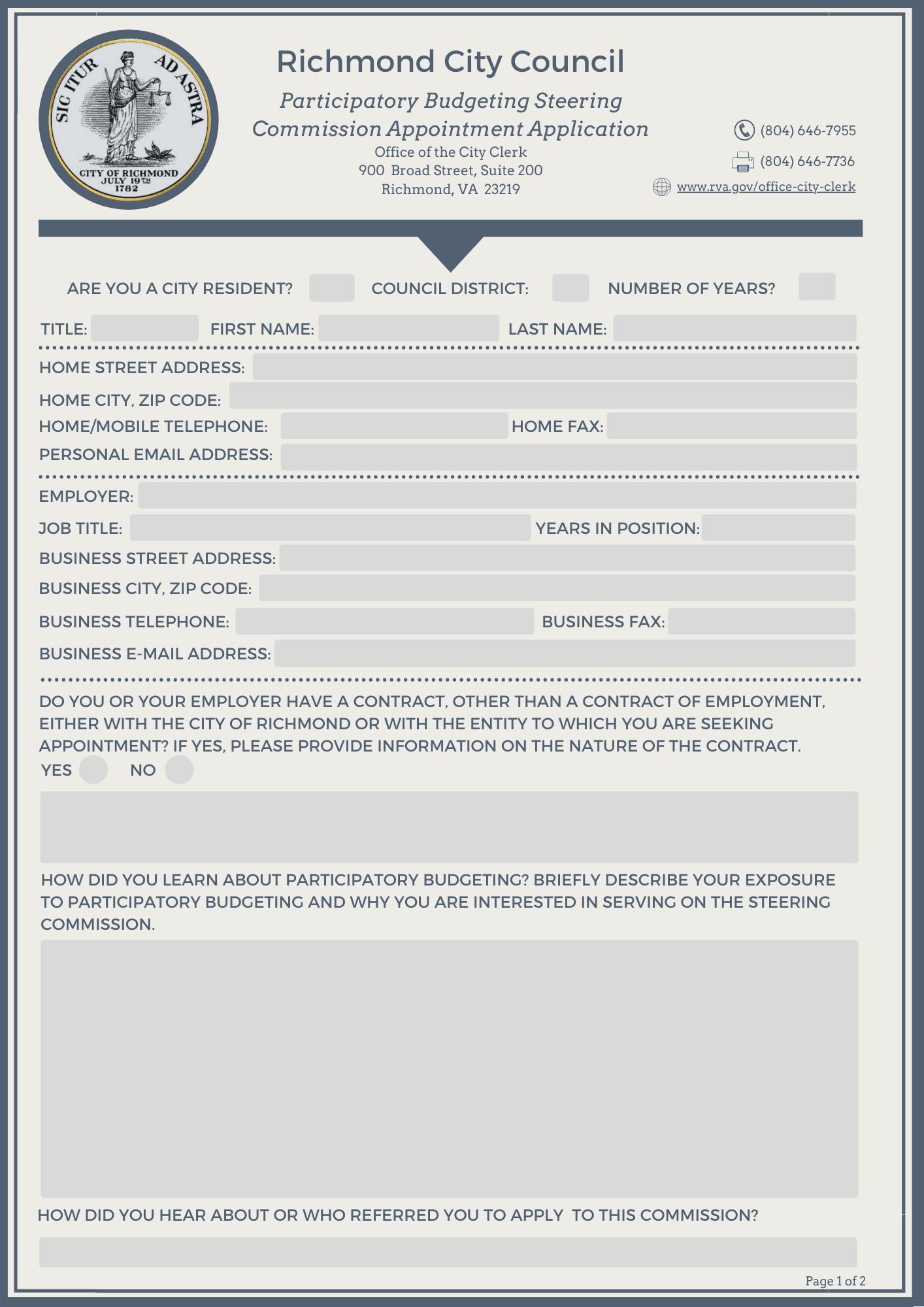

Richmond City Council is the governing legislative institution of Richmond Virginia and it represents residents in creating and amending local laws providing government policy and oversight and establishing the annual Richmond Government Budget.

. To learn more about credit. Visit myLTSA for more information about myLTSA and becoming a customer. Partial street name not prefixed by street direction may.

Personal Property Registration Form An ANNUAL filing is required on all. If you require a Property Tax Certificate please visit one of the websites noted below. The City of Richmond is authorized by state law to levy taxes on real property in the city of Richmond.

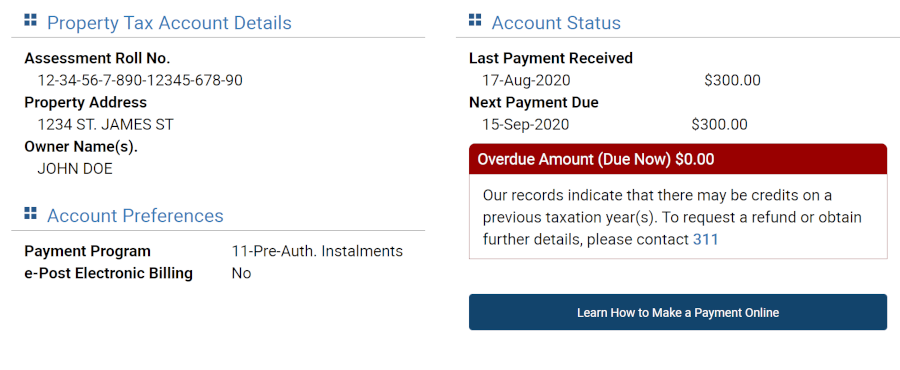

Understanding Your Tax Bill. Use this form to report non-emergency concerns regarding your property services and utilities or problems in your neighbourhood like street lights out or pot holes. For Real Estate Tax Payments you will need your 5 digit Account Number and your Bill Number.

100 453 12th Ave W unit number house number street name direction Folio. Ranking Cuyahoga County towns for bills on typical homes in each city Solving Richmonds Money Problem. These agencies provide their required tax rates and the City collects the taxes on their behalf.

If you already have an account logon now. Not all senior citizens still qualify for Ohio property tax discounts. 3 Road Richmond British Columbia V6Y 2C1 Hours.

Best Mortgage Rates in Richmond. Homestead savings calculator Town of Richmond When your neighbors are delinquent on property taxes Solving Richmonds Money Problem 2120 Lakeview Ave Property tax bite. The City of Richmonds 2020 residential rate is 180065 per 1000 of assessed property value.

If you do not have an account. Due Dates and Penalties for Property Tax. In case of an emergency call the City of Richmond 24 Hour Call Centre at 604-244-1262.

For any questions or inquiries about your property tax rate or property tax bill you can reach out to the city of richmonds property tax department through. Select a property using the Select Properties tab. Do not enter the building number or street direction in this field.

Ranking Cuyahoga County towns for bills on typical. City of Richmond BC Loss of farm status could see huge tax increases Richmond Free Press November 14 Richmond property taxes Richmond Free Press February 25 Richmond seniors and fixed ie earners are most affected by the. The City of Richmond will be hosting the Juneteenth Family Day and Festival on Saturday June 18 2022.

To pay your 2018 and prior City delinquent taxes online visit the following website. For any questions or inquiries about your property tax rate or property tax bill you can reach out to the city of Richmonds property tax department through the following methods. Richmond Hill now accepts credit card payments for property taxes.

Select the information you want using the View Property Details tab. Richmonds low taxation is a result of the ongoing commitment by City Council and City Administration to focus on fiscal responsibility allowing them to effectively manage expenditures while still providing high quality services to a growing population. You must call the Treasurers Office to obtain the amount due.

Your annual property taxes collected by the City of Richmond funds municipal services and other taxing agencies such as the Province of BC School Tax TransLink BC Assessment Authority Metro Vancouver and the Municipal Finance Authority. Every ten years local governments use new census data to redraw their district lines to reflect how local populations have changed. Personal Property Taxes are billed once a year with a December 5 th due date.

Click here for Council information members legislation meetings laws. For example entering W0210213 will display the list of all Parcel IDs starting with W0210213. The general portion is used for general government purposes the parks portion is used to fund the establishment and.

For Personal Property Tax Payments you will need your 5 Digit Account Number. My Property Account is an online profile that gives you secure access to information regarding your City of Richmond accounts such as Utility Billing Dog Licences and Property Taxes - 24 hours a day 7 days a week. Visit our credit card payment page to access this option.

Redistricting 2020 Census. When your neighbors are delinquent on property taxe. All City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to paying 2019 or newer property taxes to the Ray County Collector.

Finance Taxes Budgets. Report a Problem Request a Service. Press 3 for property tax and all other payments Enter Jurisdiction Code 9010.

Welcome to the My Property Account online access for the City of Richmond. City of Richmond - My Property Account. Manage Your Tax Account.

With this option the company that processes the payment will collect a 25 service fee. Property values are determined by the City Assessor and the Department of Finance issues the tax bills based on the valuation information provided by the Assessors Office. Public Information Advisory - Governmental Operations Committee Meeting Cancelled.

Governmental Operations Committee Meeting - April 27 2022 at 200 pm. Property tax bite. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp.

Search by Property Address. Public Information Advisory - May 2 2022 Combined Sewer and Drinking Water Plant Facilities Tour. Revised Public Information Advisory - FY 2023 Council Budget Schedule.

City of Richmond Community Information Facebook Page. City of richmond 2019 and newer property taxes real estate and personal property are billed and collected by the ray county collector. Visit APIC if you prefer to pay for the tax certificate.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

Where Do I Find My Folio Number And Access Code Myrichmond Help

Richmond Hill Property Tax 2021 Calculator Rates Wowa Ca

Municipal Property Assessment Mpac City Of Richmond Hill

Tax Exempt Bond Program Richmond Redevelopment Housing Authority

About Your Tax Bill City Of Richmond Hill

Boards And Commissions Richmond

Municipal Court City Of Richmond

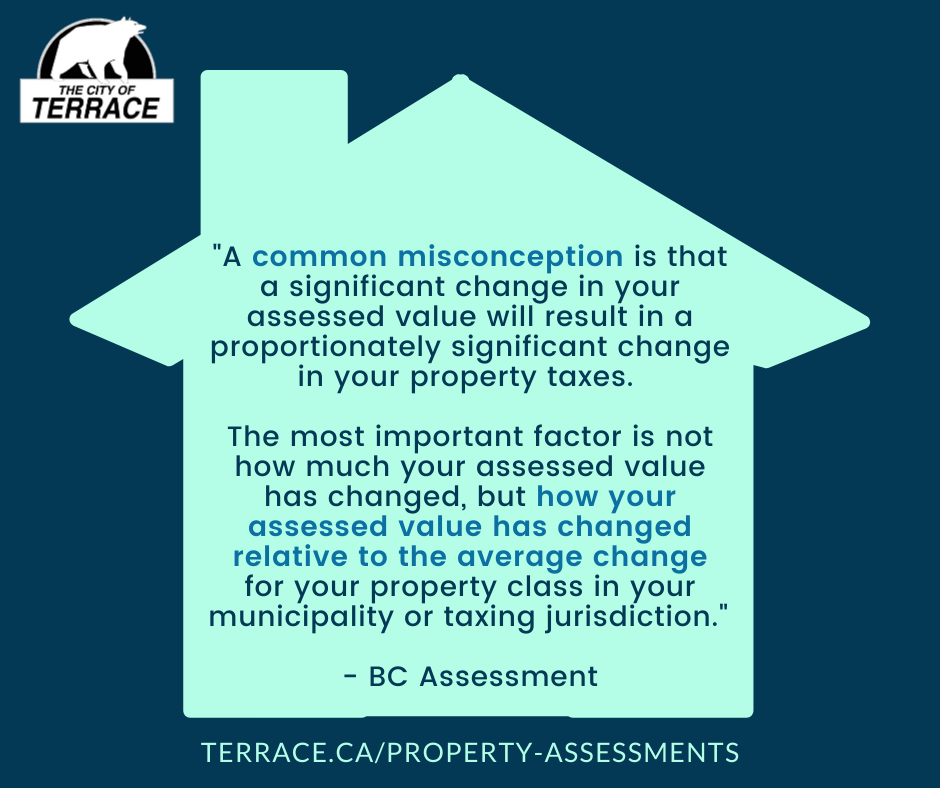

Property Assessments City Of Terrace

Where Do I Find My Folio Number And Access Code Myrichmond Help

Virginia Assessor And Property Tax Records Search Directory

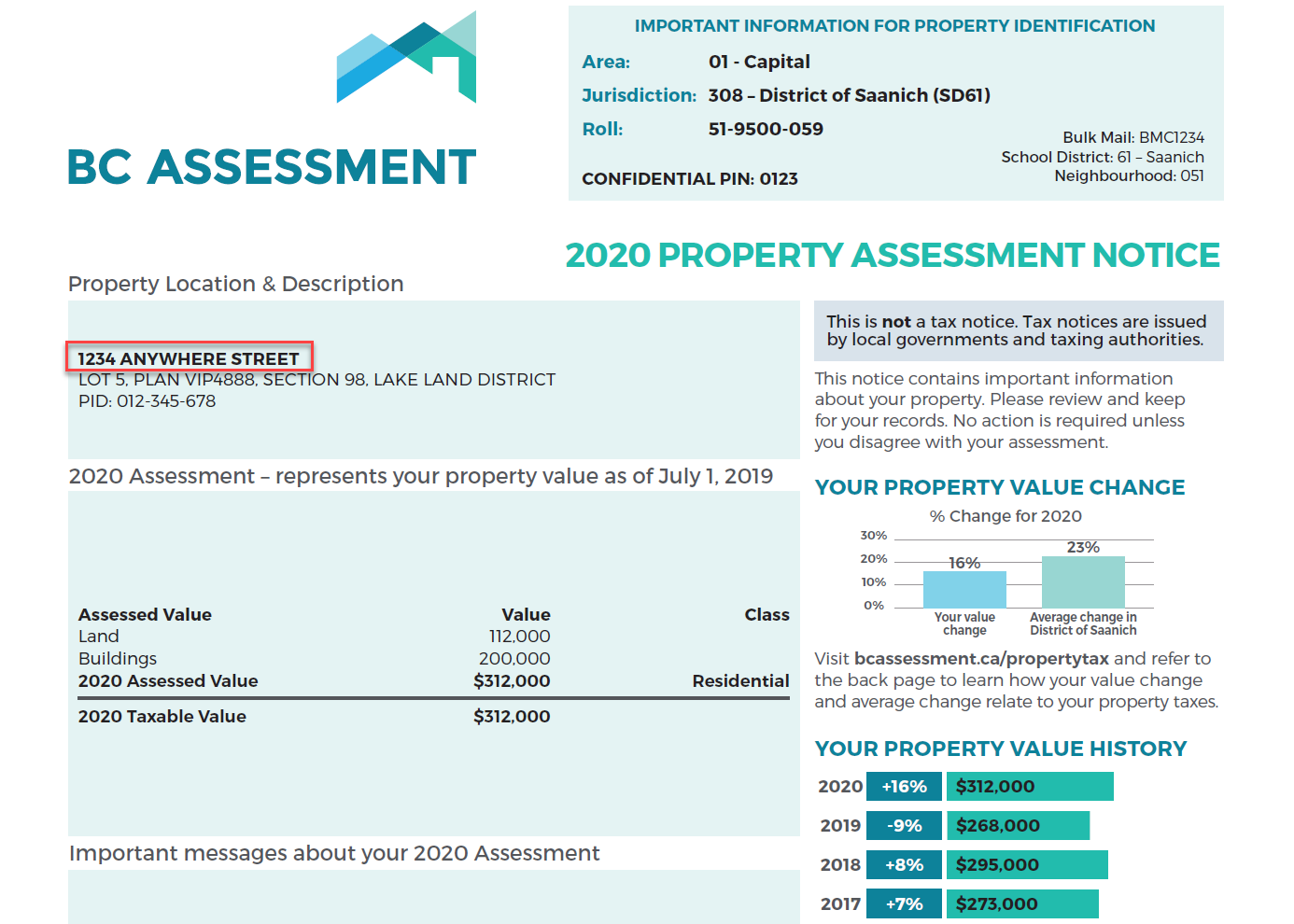

Lower Mainland 2022 Property Assessments In The Mail

Property Assessments City Of Mission

About Your Tax Bill City Of Richmond Hill

About Your Tax Bill City Of Richmond Hill

Boards And Commissions Richmond

Property Assessment Assessment Search Service Frequently Asked Questions